Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

This session provides a foundational understanding of the rules and regulations governing ACH (Automated Clearing House) transactions in the United States. Participants will learn about the NACHA Operating Rules, key federal regulations, and industry standards that shape ACH processing. The course covers the responsibilities of financial institutions, risk considerations, and how to ensure compliance with regulatory requirements. This training is ideal for compliance officers, operations teams, fintech partners, and anyone involved in payments or money movement.

The direct examination presentation outlines how attorneys can elicit truthful, credible testimony w...

Bias and discrimination continue to shape workplace dynamics, legal practice, and professional respo...

MODERATED-Part 1 of 2 - In this presentation, I will discuss strategies for cross-examining expert w...

MODERATED-Session 10 of 10 - Mr. Kornblum, a highly experienced trial and litigation lawyer for over...

We are at that time again. Resolution time. Or maybe they’re already nothing more than another...

This presentation explores courtroom staging—how movement, spatial awareness, posture, and pre...

This presentation examines how “sense memory,” a core acting technique, can help lawyers...

Mary Beth O'Connor will describe her personal history of 20 years of drug use and 30+ years of sobri...

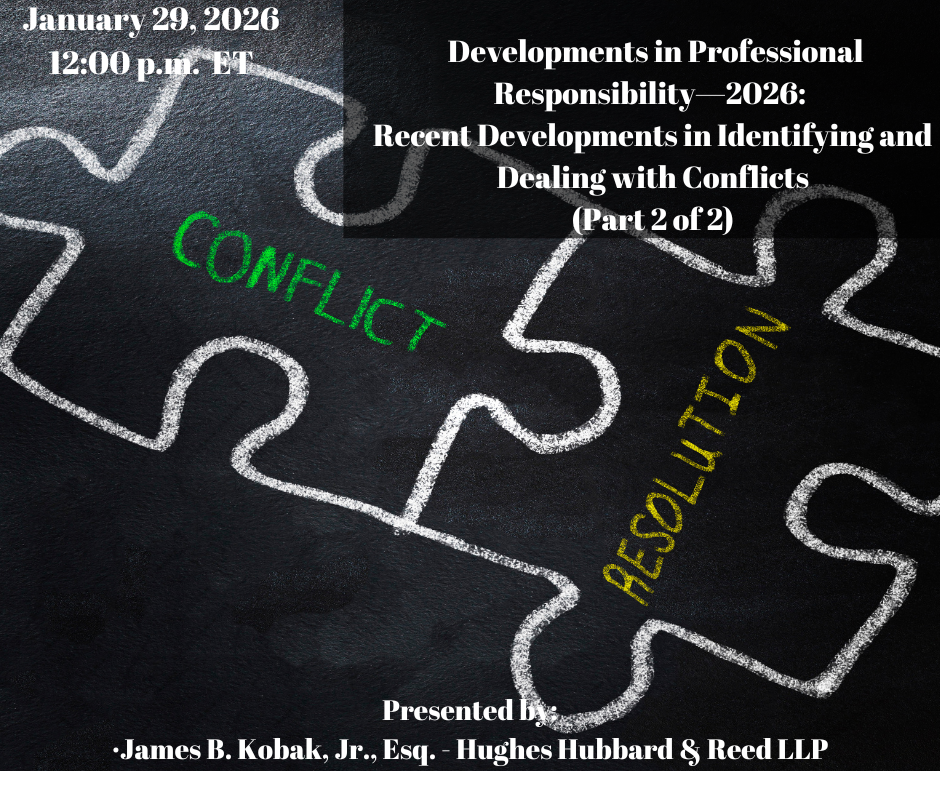

Part 2 of 2 - Lawyers at all levels of experience and even sophisticated law firms and general couns...

This Shakespeare?inspired program illustrates how Shakespearean technique can enrich courtroom advoc...