Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

This program focuses on effective tax planning strategies and transaction structures in the current economic climate. Topics covered will include: understanding buyer/seller business and tax preferences, maximizing after-tax proceeds in an exit, incentivizing key employees, structuring earnouts/deferred payments, structuring recapitalizations and debt work-outs, protecting against reporting compliance risks, and preserving qualified small business stock (QSBS) status for gain exclusion.

The format will feature case studies for issue spotting exercises and practical guidance for counseling clients (whether internal or external).

Learning Objectives:

• Identify the tax benefits and risks of different transaction structures for buyers and sellers Understand how certain tax due diligence items can materially impact value in the current climate

• Recognize traps for the unwary in the course of business exit planning

• Learn how problems can be solved through various structuring techniques

Successful personal injury defense practice requires far more than strong legal arguments—it d...

Review the basic software concepts and effective uses of generative AI, prompting strategies, and me...

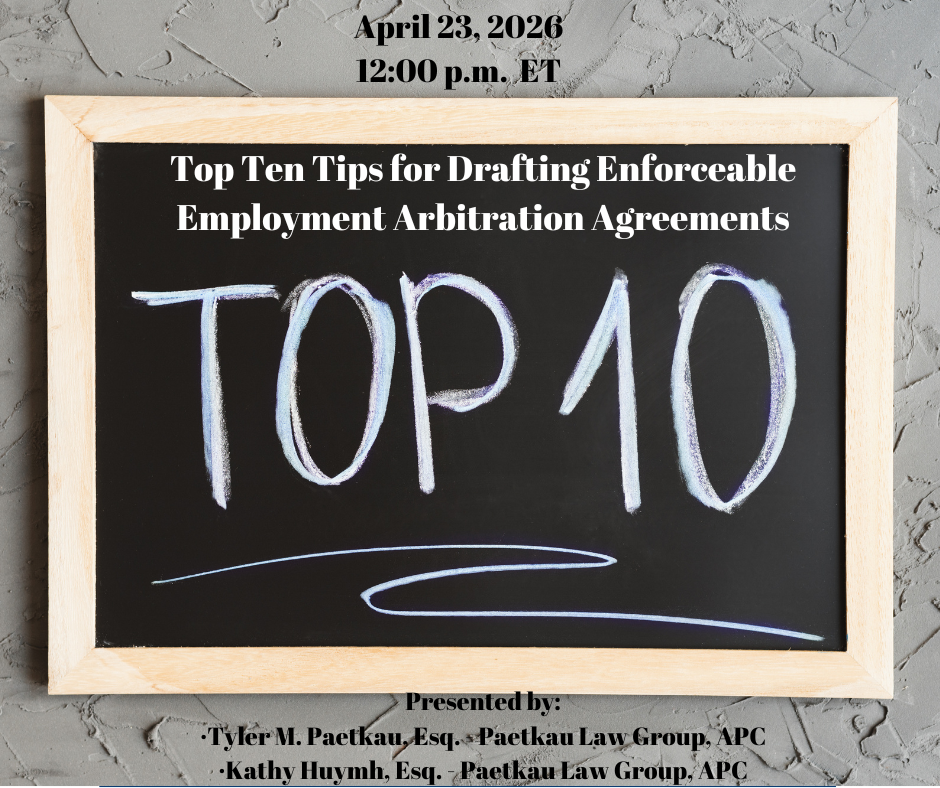

In the rapidly evolving landscape of employment law, arbitration agreements have become a cornerston...

This program provides a comprehensive analysis of the Sixth Amendment Confrontation Clause as reshap...

Disasters, whether natural or manmade, happen. Disasters can impact the practice of law and, among o...

Part II builds on the foundation established in Part I by examining how classical rhetorical styles ...

Aligning Your Legal Career with Your Values, explores the profound impact of values alignment on ind...

The direct examination presentation outlines how attorneys can elicit truthful, credible testimony w...

The CLE will cover the Ins and Outs of Internal Corporate Investigations, including: Back...

Evidence Demystified Part 2 covers key concepts in the law of evidence, focusing on witnesses, credi...