Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

Our seminar will explore essential financial and tax concepts that all Lawyers must know in order to properly guide clients as well as to secure their own economic futures. Seminar concepts and discussion arise from Cynthia Sharp’s book The Lawyers’ Guide to Financial Planning recently published by ABA Book Publishing.

Topics covered include:

THREE HOURS

Opening Remarks – 15 minutes

Topic 1 – 30 minutes

Topic 2 – 45 minutes

Break – 15 minutes

Topic 3 – 15 minutes

Topic 4 – 30 minutes

Topic 5 – 30 minutes

Conclusion – 15 minutes

This program explores listening as a foundational yet under-taught lawyering skill that directly imp...

Part 2 - This program will continue the discussion from Part 1 focusing specifically on cross?examin...

The filing of multiple RICO complaints in federal courts in New York State against plaintiffs’...

United States patent law and the United States Patent and Trademark Office’s patent-related gu...

The landscape of global finance is undergoing a seismic shift as traditional assets migrate to the b...

This program provides attorneys with a practical and ethical framework for understanding and respons...

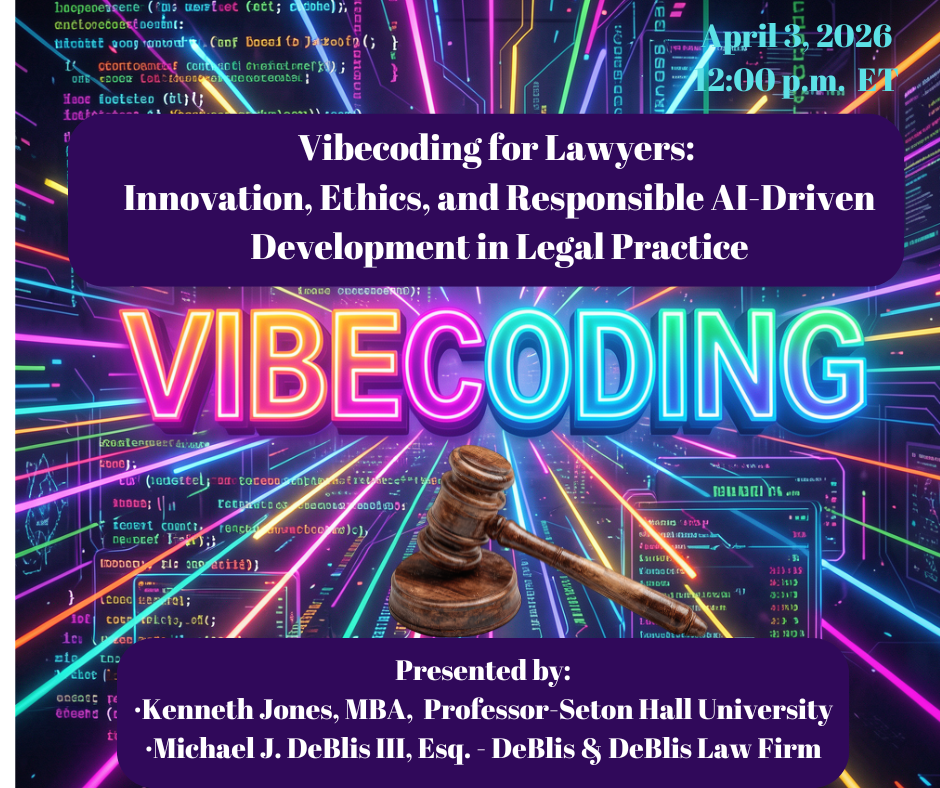

Review the basic software concepts and effective uses of generative AI, prompting strategies, and me...

Disasters, whether natural or manmade, happen. Disasters can impact the practice of law and, among o...

This presentation teaches attorneys how to deliver memorized text—especially openings and clos...

This CLE program examines attorneys’ ethical duties in managing electronically stored informat...