Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

The seminar will explore the advantages and disadvantages of a variety of trust strategies and other arrangements currently available to retirement plan owners who do not wish leave their retirement plans outright to their heirs at death. Trust strategies to be discussed include conduit trusts, accumulation trusts, and testamentary charitable remainder unitrusts. Charitable gift annuities and outright bequests to donor advised funds and private foundations comprise the other arrangements to which attention will be given. Each trust strategy and each other arrangement will be examined for use with each of the five types of eligible designated beneficiary and also with heirs who do not qualify as such.

Resilience in the Workplace, delves into the critical importance of resilience in navigating the cha...

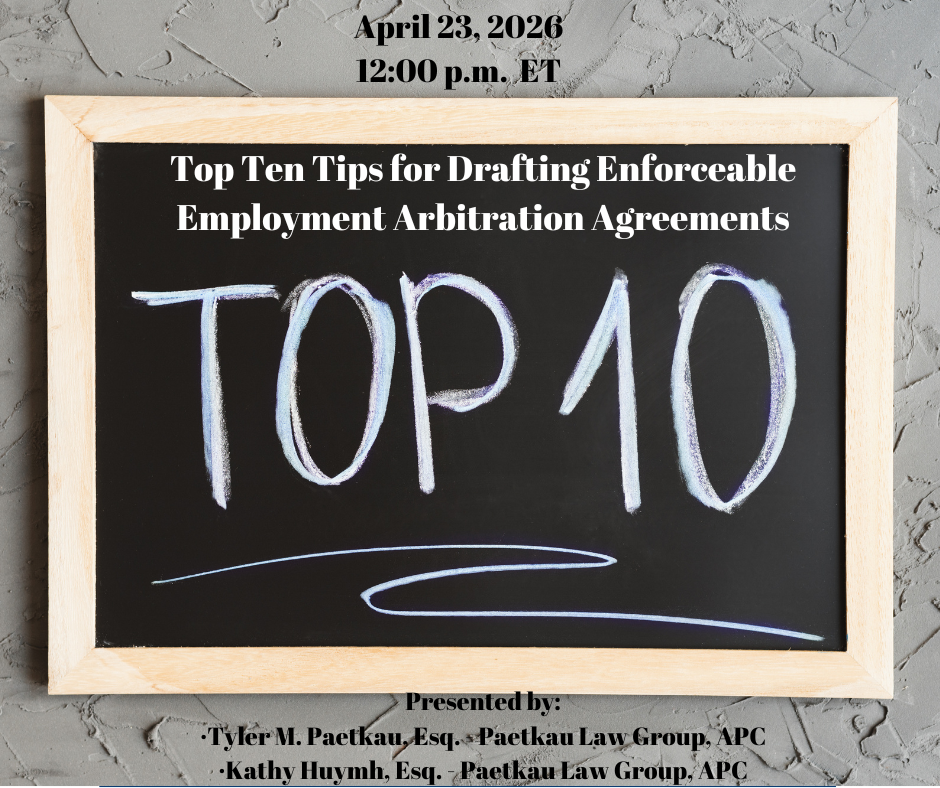

In the rapidly evolving landscape of employment law, arbitration agreements have become a cornerston...

This session highlights the legal and compliance implications of divergences between GAAP and IFRS. ...

This program focuses on overcoming the inner critic—the perfectionist, self?doubting voice tha...

Part 1 - This program focuses specifically on cross?examining expert witnesses, whose credentials an...

This program examines critical 2025-2026 developments in patent eligibility for software and AI inve...

In “Choosing the Right Business Entity,” I will walk through the issues that matter most...

Part II builds on the foundation established in Part I by examining how classical rhetorical styles ...

Attorneys hopefully recognize that, like many other professionals, their lives are filled to the bri...

This attorney-focused program reviews upcoming Nacha rule changes for 2026 with emphasis on legal ob...