Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

This course breaks down GAAP’s ten foundational principles and explores their compliance implications for legal practitioners. Attorneys will learn how GAAP violations surface in regulatory actions, contract disputes, financial investigations, and due diligence, enabling more informed legal assessments of financial records.

This program explores listening as a foundational yet under-taught lawyering skill that directly imp...

Evidence Demystified Part 2 covers key concepts in the law of evidence, focusing on witnesses, credi...

This program focuses on overcoming the inner critic—the perfectionist, self?doubting voice tha...

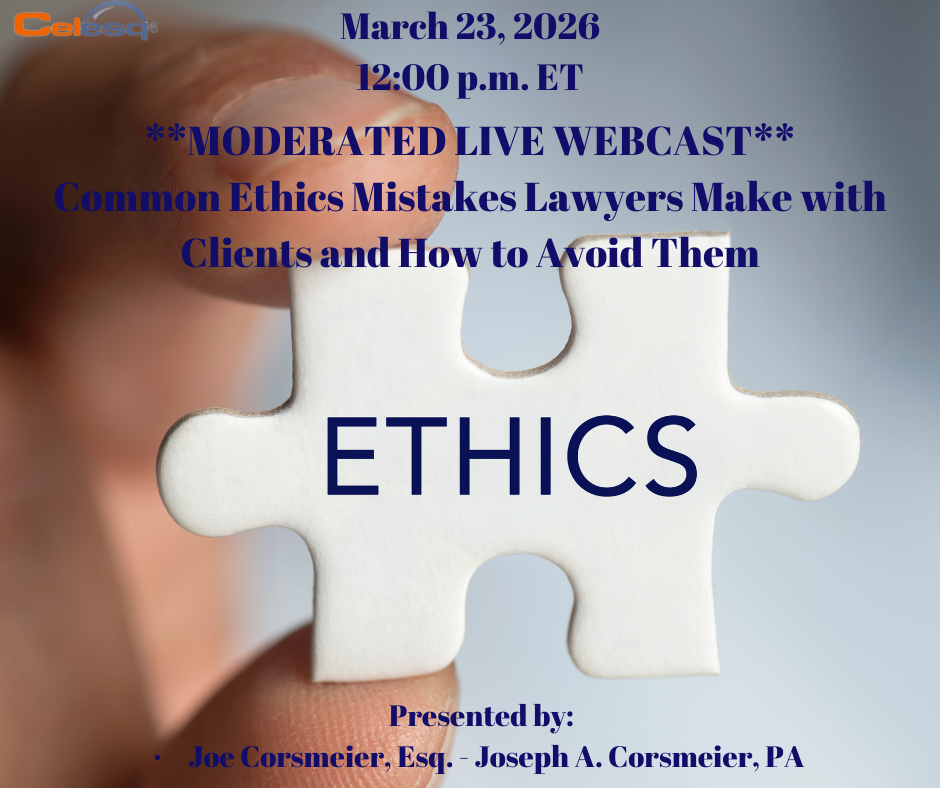

Many lawyers may not fully understand the Bar rules and ethical considerations regarding client repr...

The direct examination presentation outlines how attorneys can elicit truthful, credible testimony w...

‘A Lawyer’s Guide To Mental Fitness’ is a seminar designed to equip professionals ...

Explore the transformative potential of generative AI in modern litigation. “Generative AI for...

Attorneys will receive a comparative analysis of GAAP and IFRS with emphasis on cross-border legal c...

This CLE program examines attorneys’ ethical duties in managing electronically stored informat...

The CLE will cover the Ins and Outs of Internal Corporate Investigations, including: Back...