Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

This course provides attorneys with a foundational understanding of real estate taxation, covering key topics such as mortgage points, closing costs, and tax basis. Participants will learn about deductions for rental properties, home office tax considerations, capital gains implications, and the benefits of 1031 exchanges.

By the end of the course, attorneys will be equipped to navigate the tax aspects of real estate transactions and provide valuable guidance to their clients.

• Getting a basic understanding of taxation involving real estate

• Taxes on points on a mortgage

• Closing Costs and Tax Basis

• Deductions on rental properties

• Home Office Consideration

• Capital Gains

• 1031 Exchanges

----------------------------------------------------

Stephen's book, Disinheriting the IRS: Tips & Tactics to Stop Uncle Sam from Taking Your Legacy reached the rank as Amazon’s #1 International Best Selling Book in both soft cover and Kindle versions in the United States and Canada in the categories of Taxes, Retirement Planning, Tax Accounting, Personal Taxes, and Accounting.

Here is the amazon link to purchase the book: https://a.co/d/eghbUWQ

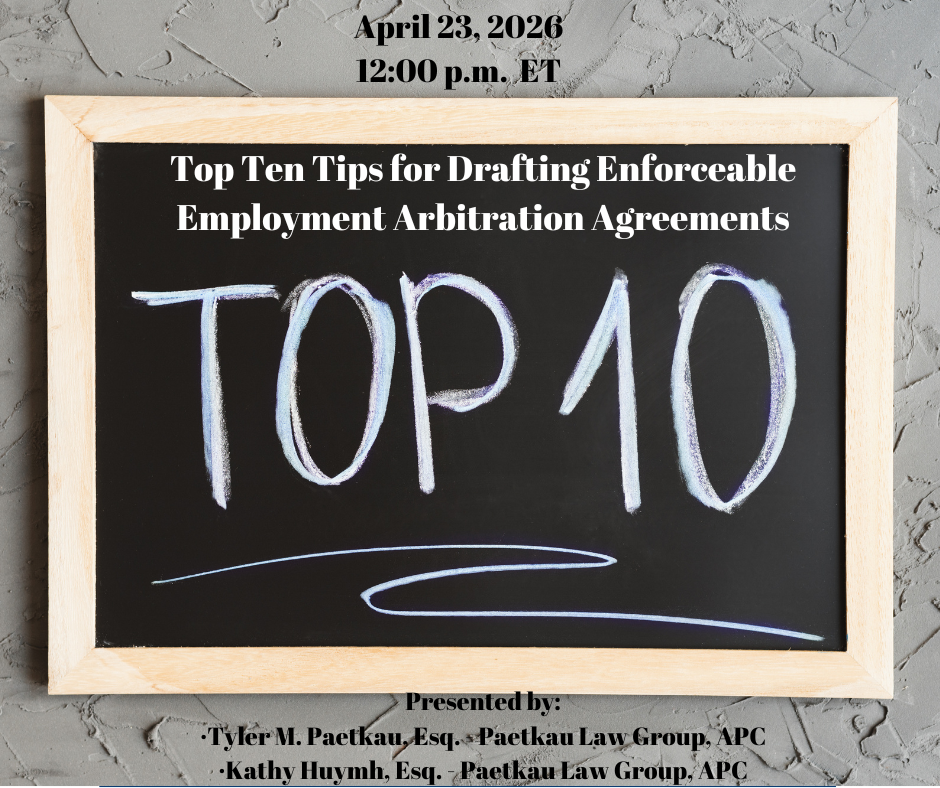

In the rapidly evolving landscape of employment law, arbitration agreements have become a cornerston...

This program provides a comprehensive analysis of the Sixth Amendment Confrontation Clause as reshap...

If there is one word we heard during our journey through the pandemic and continue to hear more than...

Aligning Your Legal Career with Your Values, explores the profound impact of values alignment on ind...

This session highlights the legal and compliance implications of divergences between GAAP and IFRS. ...

Recent studies have shown that there has been a dramatic increase in impairment due to alcoholism, a...

Large World Models (LWMs)— the next generation of AI systems capable of generating...

Evidence Demystified Part 1 introduces core evidentiary principles, including relevance, admissibili...

This course provides a strategic roadmap for attorneys to transition from administrative burnout to ...

Boundaries and Burnout: The Hidden Crisis in Law is a 60-minute California MCLE Competence Credit pr...